How can we support your projects in 2023?

Tomasz Wozniak

Tomasz Wozniak  January 30, 2023

January 30, 2023  Tomasz Wozniak

Tomasz Wozniak  January 30, 2023

January 30, 2023 Welcome to 2023! At Holocene, we are looking forward to opportunities that will unfold as we are moving into 2023. Last week we wrote about 4 key trends for 2023 and this week we wanted to summarize 4 ways in which our team can support your business goals. Specifically, for 2023, our focus will be on:

2022 was quite a turbulent time for the real estate finance market. Increased cost of borrowing has deemed a lot of projects not feasible and availability of credit from certain institutions was significantly limited. We expect 2023 to be quite different.

First, there is plenty of capital available if you just know where to look. At Holocene we work with a variety of funding partners which allows us to find unique solutions for our clients. Our funding partners include:

Second, using alternative financing sources (which we define as non-bank financing), will become more common. These solutions do tend to carry pricing premium. However they also offer a great level of flexibility and speed of execution.

By using Holocene for real estate financing requirements, our clients benefit from our wide network of funding partners (now covering 100+ countries) and ensure that financing terms they receive create an optimal package for their circumstances.

Second area of focus for 2023 concerns cross-border transactions. It was one of leading trends last year and we think that this will continue in 2023 and beyond.

We appreciate that a lot of our clients already have an existing network of funding providers in their respective countries. However, even if that is the case, we encourage our clients to explore financing options outside of their home country to make sure that terms they are receiving are the most competitive option on the global market. Availability of cross-border capital is constantly increasing, and we can help our clients with navigating that part of the market.

Moreover, some of our clients have business interests in multiple countries and our team can put together financing packages that will be suitable for this circumstance so that clients can work with a single capital provider.

Financing of renewable and green energy projects is another key area for us. We can support global projects that aim to support the transition to renewable and green energy.

We are seeing a lot of interest from investment groups to support these projects – not only for energy generation but also for adjacent projects such as transportation of energy, battery storage etc. Specifically, we are seeing an appetite for renewable energy projects in Southern Europe as well as hydrogen related transactions in the US thanks to the Inflation Reduction Act.

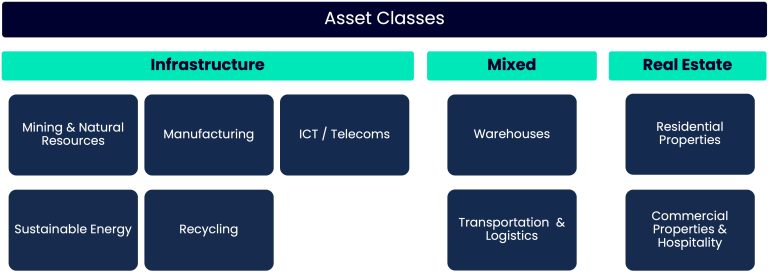

We also act on behalf of capital providers by identifying suitable investment and lending opportunities across an entire spectrum of assets.

Our sentiment for 2023 is overall positive – we are expecting activity to pick up following the slow down in the last quarter of 2022 and we are delighted to support our clients and partners in their ventures. Please send details of your requirements to info@holoceneic.com and we will get back to you within 24 hours to discuss further.