Financing market for infrastructure and real estate

Tomasz Wozniak

Tomasz Wozniak  September 11, 2024

September 11, 2024  Tomasz Wozniak

Tomasz Wozniak  September 11, 2024

September 11, 2024 In this month’s briefing, we will explore global project finance trends and explain Holocene’s core specialisation.

We cover types of projects that are considered the most attractive by our financing partners, specifically breaking down the universe of projects into categories based on asset class as well as overall project characteristics.

The goal of the article is to explain what types of projects we are based positioned to support.

The market is witnessing robust demand from financial firms across several asset classes, each with its own unique drivers and challenges, supported by substantial financial war chests. As of July 2024, the global total of dry powder — unallocated capital held by private equity and venture capital—reached a staggering USD $2.62 trillion, up 177% since 2000.

Additionally, with the general rule that for every $1 of equity committed unlocks $2 of debt, this implies there is over $5 trillion in unutilized debt available for investments. All told, you’re looking at over $7 trillion that could go into investments that have not yet materialized – comparable to the combined annual GDP of Japan and the UK.

Infrastructure remains a cornerstone of investment demand, driven by the need for modernization and expansion of essential services. Developed countries face significant pressure to upgrade aging infrastructure after years of under-investment. For example, in Germany, the cost to upgrade creaking municipalities was estimated to be EUR 149 billion back in 2021.

In contrast, emerging markets are focusing on catching up with developed nations on their path towards one day reaching high-income status. McKinsey, a consulting firm, estimates the cost would equal to $2 trillion per year over the next 15 years just to maintain current levels of economic growth, not even to get ahead. In Indonesia, you can see this at work. The country has been leading the charge with multi-billion-dollar investments in ports, transportation, and nickel smelting facilities to enhance its value chain.

Renewable energy projects, including solar, wind, and waste-to-energy, are witnessing sustained demand, bolstered by global efforts to transition towards a more sustainable energy mix. According to the International Energy Agency (IEA), global renewable energy capacity was set to increase by a record 440 gigawatts (GW) in 2023, a 13% rise compared to 2022, with China, the European Union, the United States, and India leading this growth. The focus on decarbonization and energy security, coupled with technological advancements, has further accelerated investment in renewables. By 2030, renewables are expected to account for nearly 50% of the global power generation mix, up from 29% in 2022. It won’t come cheap though. Current estimates put the world’s climate targets at $4.5 trillion per year.

According to PwC, a consulting firm, global real estate transaction volumes are expected to reach approximately USD $1.4 trillion by the end of the year, reflecting a cautious but stable recovery in the market.

The global real estate market is also seeing a strategic shift towards mixed-use developments that combine residential, commercial, and retail spaces. This approach is driven by the need to create vibrant, resilient communities that can adapt to changing consumer behaviors and economic conditions. JLL’s Global Real Estate Outlook 2024 notes that flexible office spaces, which accounted for 3% of global office stock in 2023, are expected to grow to 10% by 2030. Additionally, the transformation of retail environments is highlighted, with global e-commerce sales projected to exceed USD $7 trillion by 2025, driving demand for innovative, experiential shopping spaces.

Mixed assets (logistics hubs, warehouses, energy storage facilities, and data centres), are emerging as vital components of the modern sustainable economy. JLL in recent months has highlighted the importance of logistics and industrial properties, noting that these sectors attracted over USD $250 billion in global investments in 2023 alone. The resilience and strong performance of logistics and industrial assets are expected to continue, with annual growth rates of around 6-7% projected through 2026.

So with all this capital to spend and asset classes on the rise, what interests the world of project finance these days?

Investors and lenders generally show a strong preference for allocating capital at the project or asset level rather than at the “Top Co” (company) level. Project-level investments are perceived as lower risk and more directly tied to tangible outcomes. However, when Top Co investments are required, they typically target established companies seeking to expand their operations through growth equity, often directed towards scaling operations, acquiring additional sites, or mergers and acquisitions.

The size of the investment, or “ticket size,” is another critical factor in the current market environment.

While smaller projects are not entirely excluded altogether (under EUR 10M), the focus should remain on a portfolio/pipeline of projects that reach the minimum target amount. The projects themselves can be at various stages of readiness. Ideally, the first project in any pipeline should be as close to “Ready to Build” as possible. For example, the first project in the pipeline might be EUR 5 million and Ready to Build, with the other ones in the portfolio matching the size, but expected to be built in a few years.

While many investors say they are open to tech risk and next generation solutions, the market on the whole shows a strong preference for proven technologies, as they allow for smoother due diligence processes at the project level. When novel technology is involved, additional information and requirements are necessary to mitigate perceived risks. These extra requirements could include comprehensive engineering reports, feasibility studies, clear demonstrated ownership of associated intellectual property, and appropriate insurance coverage. The added benefit of proven technologies is the ability for speed and scale to meet climate and energy demands.

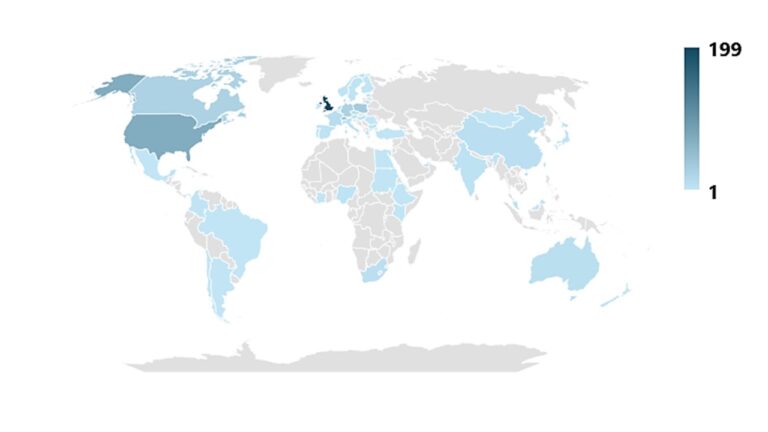

Holocene’s expertise is rooted in our extensive network and ability to navigate complex markets. Our infrastructure and energy projects span the globe, with different regions offering varying scopes of opportunity. We maintain relationships with over 580 funding partners across 62 countries, including 199 in the UK alone. For a map of our funding partners, please refer to the map below.

We specialize in mid-sized projects, particularly those in the EUR 10-100 million range . Unlike large institutions that may overlook smaller opportunities, Holocene has the flexibility and agility to engage with projects at this scale.

Remember to keep the following check-list in mind to see if we can help you get your project off the ground.

If you would like to get in touch, email us as [email protected]