How can HIC support your Infrastructure projects?

Tomasz Wozniak

Tomasz Wozniak  July 11, 2023

July 11, 2023  Tomasz Wozniak

Tomasz Wozniak  July 11, 2023

July 11, 2023 So far, in 2023, we have seen an increased number of enquiries relating to infrastructure projects, with focus specifically on sustainable power generation. Financing of such projects is at the heart of what we do at HIC and this month we wanted to highlight our involvement in such projects

Specifically, we will focus on:

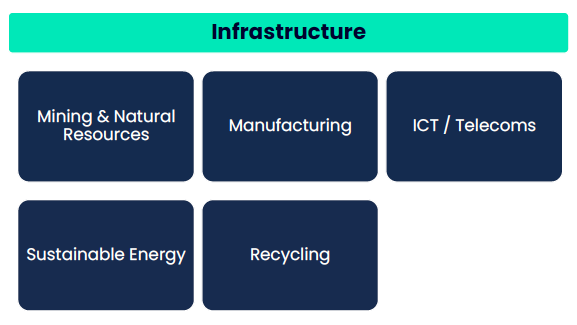

For infrastructure projects we focus on key five areas: mining & natural resources, manufacturing, ICT & telecoms, sustainable energy and recycling.

Regarding geographies, we are proud to offer truly global financing solutions for projects across North and South America, Europe, Africa, Asia and Oceania.

At HIC we offer bespoke capital solutions for our clients. To outline a high-level overview of financing solutions we will focus on three items: types of capital available, types of funding partners we work with and types of transactions we can support.

Our financing solutions cover three key parts of the capital stack – senior debt, mezzanine debt and equity investments. It is worth noting that we do not insist on arranging the entire capital stack for our clients – as an example, we would be happy to work with a developer who has already raised senior debt and equity and is missing the mezzanine debt piece (which typically constitutes between 15% – 30% of the overall project cost).

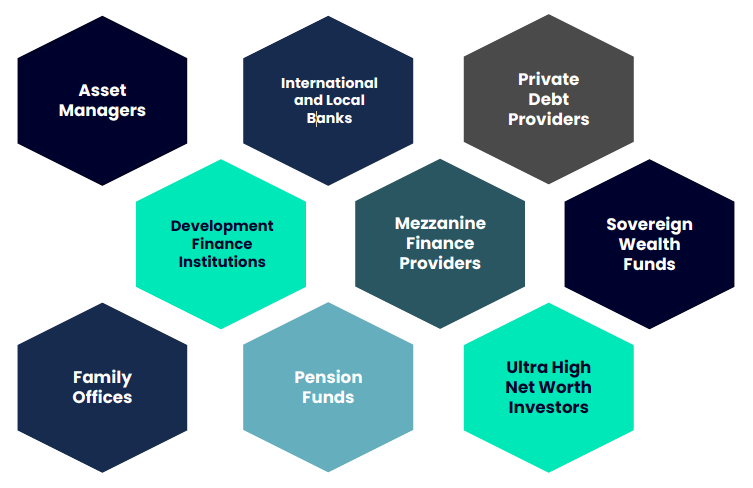

We work with a variety of funding partners that include (but not limited to): specialist investment firms, debt funds, local and international banks, development finance institutions, sovereign wealth funds, family offices and pension funds.

Funding partners that we end up approaching on an individual project will be driven purely by the project itself and by the client’s requirements.

We can support a variety of transactions for corporations at various stages of development – we can work with clients who are just starting their projects and are in the process of developing their first facility as well as with mature companies that are already operating and looking for capital to further grow their business.

Each of our clients can access our financing solutions to develop their projects and construct their facilities, purchase operating equipment, obtain working capital loans, and even attract growth equity capital.

You can reach our team at info@holoceneic.com or on +41 78 737 64 24. We would be delighted to learn more about your project and requirements.

Shortly after the initial conversation we will assess your project to determine which of our funding solutions might be the most relevant to your projects. From there, we will work with you to negotiate the best possible financing terms and to support you during the due diligence process.