Mezzanine finance in real estate

Tomasz Wozniak

Tomasz Wozniak  December 20, 2022

December 20, 2022  Tomasz Wozniak

Tomasz Wozniak  December 20, 2022

December 20, 2022 Welcome to the last edition of 2022’s Real Estate Newsletter.

To conclude the year we wanted to give you a short summary of a type of financing commonly used in Real Estate – mezzanine loan.

We will start by defining mezzanine loan and then we will shift the focus to two key questions:

For previous editions of our Real Estate Newsletter please visit our Insights page.

A mezzanine real estate loan is a product combining debt and equity instruments. It acts as debt as it has fixed maturity and interest payments. However, unlike senior loans, it is not secured against the underlying asset and in the event of a default it converts into equity.

In a capital stack it sits between senior debt and equity meaning that the mezzanine lender will be paid after the senior lender but before the equity shareholder.

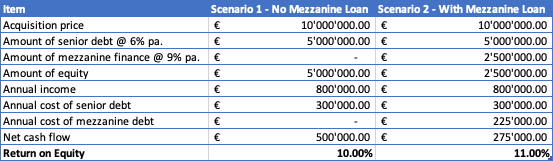

There are clear benefits in using mezzanine finance to structure your real estate transaction. It allows you to decrease the equity contribution and improve the ROE of the project – please refer to the example below:

As a result, the sponsor was able to decrease their equity contribution without diluting their shareholding as well as increase the ROE of the project.

Mezzanine loans also provide more flexibility than standard senior loans – typically lenders involved in the mezzanine space are capable of accepting higher risk (compensated by higher rate of return).

As mentioned in the first paragraph, mezzanine loans are typically not secured against the underlying asset. Instead, the borrower taking up the mezzanine loan is asked to pledge their ownership in the project. A default then triggers change of ownership and the lender that provided the mezzanine loan in the first place becomes the owner of the borrower’s shares (at this point the mezzanine loan converts into common equity structure).

Key point to remember is that the mezzanine lender in this case would become responsible for senior loans therefore ranking second in the repayment order.

Get in touch with us today to discuss your transaction and whether mezzanine finance might be a relevant solution for you.