Real Estate in Q2 2022

Tomasz Wozniak

Tomasz Wozniak  July 25, 2022

July 25, 2022  Tomasz Wozniak

Tomasz Wozniak  July 25, 2022

July 25, 2022 Summer is officially here marking the end to the second quarter of 2022. In this edition of HIC’s Real Estate Newsletter we wanted to reflect on some of the trends that we have seen in Q2 2022 as well as highlight some of the real estate transactions that we have been working on.

In the spirit of summer also check out our previous instalment of the Newsletter which focuses on buying a holiday home abroad – read it here.

Moving on, real estate trends in Q2 2022 at HIC were:

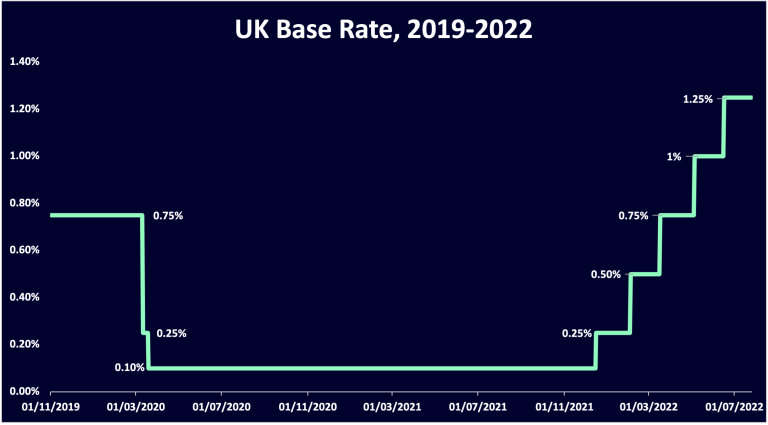

Following years of historically low interest rates we are now seeing a steady increase across markets. The Bank of England in the UK has increased rates from 0.10% (in place between March 2020 and December 2021) to 1.25%. In the US, the Federal Funds rate has been increased from 0.08% (in February 2022) to 1.21% (June 2022). Finally, the European Central Bank is expected to increase interest rates for the first time since 2011 ending their policy of negative interest rates.

Those homeowners who previously opted for variable rate mortgages (i.e. mortgage tied to a base rate) will immediately experience the impact of a rate increase. Those who fixed their mortgage rate would not be impacted, at least until they decide to refinance or purchase a new property.

Moving forward, we expect more borrowers to opt in for long-term fixed rates as the margin between short and long term interest rate continues to shrink and borrowers seek more stability.

In Q2 2022 we have seen increased appetite for lending and investing in real estate, specifically in the specialist and private part of the capital stack. As an example, we are currently working with an investment firm that historically has been very much focused on the UK market. However, this year, they have made a shift and started investing more into foreign markets around Western Europe. We have also seen short-term bridging lenders expanding their offering to cover a variety of asset classes.

On the private capital side, we are seeing great interest from single family offices as well as private individuals to fund real estate developments as these projects can provide significantly higher yields. This source of funding is especially useful for projects that don’t quite fit with the institutional lenders.

With the increased cost of borrowing real estate investors are on a hunt for superior yields. For experienced real estate professionals, commercial assets can provide just that – we have seen increased interest in that asset class on both sides (investors historically interested mainly in residential real estate as well as lenders historically financing only residential assets). It’s estimated that over £25B was invested in the UK commercial properties in the first half of 2022, about 20% over average. Financing terms remain quite competitive despite increased interest rates, as we have seen margins (between residential and commercial lending) shrinking.

Below is a summary of some of the transactions that we were working on:

We are entering a period when navigating the real estate market will become more difficult. At times like these having a trusted partner in your corner is incredibly important. We can assist with obtaining the best financing terms as well as sourcing off-market development opportunities across Europe.

The team at HIC is here to support any real estate requirements you might have – please do get in touch with us at [email protected].