Swiss Real Estate Market

Tomasz Wozniak

Tomasz Wozniak  February 23, 2022

February 23, 2022  Tomasz Wozniak

Tomasz Wozniak  February 23, 2022

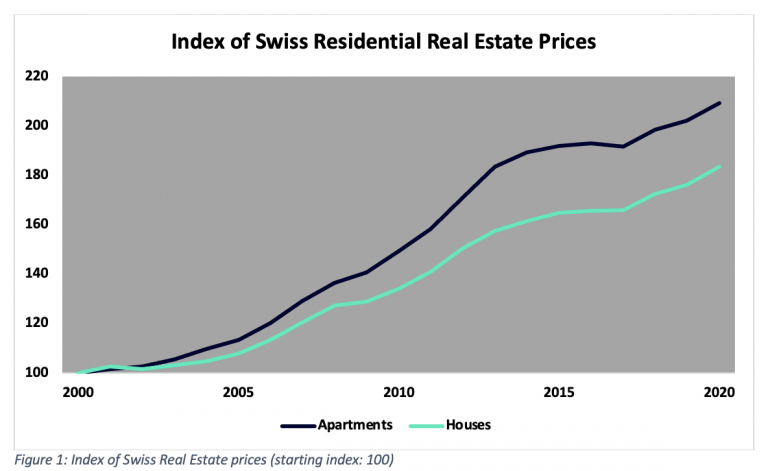

February 23, 2022 At the heart of central Europe, Switzerland has always been an popular destination for foreign nationals who make up 25% of the population. For the expat community, Switzerland is attractive for numerous reasons ranging from a world-class education system, universal healthcare, the ease of starting a business as well as the abundance of outdoor activities. From the early 2000s, the population has been steadily growing and so have real estate prices. The former has increased on average by almost 1% per year and the latter by slightly over 3% per year. According to Real Advisory, the average price for a 4 bedroom house is CHF 820,000 (CHF 6,250 per square meter). In the most desirable locations, such as Geneva, the average price can double to over CHF 13,000 per square meter.

According to the Swiss National Bank, property prices in Switzerland have enjoyed a comfortable increase over the last 20 years with apartments growing by an average of 3.79% per year and houses by 3.10%.

Looking ahead, according to Ernst & Young, the majority of real estate investors view Switzerland as an attractive market for 2022 with confidence mainly driven by the expected recovery from the pandemic, as well as ESG (“Environmental, Social and Governance”) considerations. Almost 90% of interviewed investors believe that sustainability will be taken into account by institutional investors and 75% expect that ESG compliant properties will be trading at a premium.

One of the defining aspects of the Swiss market concerns international investors (who are not residents) buying in Switzerland dating back to 1983 with the ‘Lex Koller’ legislation. According to Lex Koller, restrictions for properties depend on the status that the foreign investor holds in Switzerland – mainly, whether the foreign investor resides in Switzerland and, for those who reside in Switzerland, which residence permit they hold:

Fortunately, investors that are not residents in Switzerland can still participate in the Swiss market. According to Lex Koller, international buyers without residency in Switzerland are able to purchase properties that fall under two categories:

Certain cantons (such as Valais, home to Zermatt) allow a certain number of properties to be sold to foreign nationals. The quote changes annually and is not as generous as investors would want. However, with the right guidance, finding a deal is certainly possible.

All foreigners, regardless of the Swiss residency status, are allowed to purchase commercial real estate in Switzerland. These properties can include, for example, office buildings, hotels and shopping centers.

While rules around property ownership are complicated, there are certainly areas that anyone can explore. Please do contact us if that is of interest so we can introduce a real estate lawyer that is able to review your situation and provide further advice.

At Holocene, we are committed to helping our clients acquire properties in Switzerland. Areas that we cover include:

Based in Switzerland, we work with our partners on the ground to help you find the right property. We work with local estate agents on your behalf as well as identify off-market opportunities.

Our team has vast experience in arranging financing solutions for the acquisition of property. In Switzerland, buyers are typically required to put down 20% deposits and the remaining 80% can be arranged using mortgage financing. The Swiss market offers fixed rates as well as variable rates and pricing starts sub 1% per year.

We are always looking to work with investors who want to acquire property in Switzerland – please do not hesitate to contact us on [email protected] to discuss further.