Four key trends to look out for in 2023

Adam MacRae

Adam MacRae  January 25, 2023

January 25, 2023  Adam MacRae

Adam MacRae  January 25, 2023

January 25, 2023 For 2023, we wanted to highlight 4 issues that we believe at Holocene will define the coming year. We’ll discuss what they are, and what implications they have for 2023 and beyond.

These issues are:

Since 2014, Russia and Ukraine have been at war, which escalated on 24 February 2022 when Russia conducted a full-scale invasion.

This illegal war led to 4 major implications.

Europe’s exposure to Russian energy imports led to concerns of Russia weaponising energy access against the EU and highlighted the need to find alternative sources of energy. This in turn led to record prices in order to find and secure those alternative sources.

This shifting of energy supply for Europe, along with increased gas competition with Asia, led to an increase of 1.5% in global demand and an increase of 60% in prices.

Looking ahead: Europe and its allies recently launched a $60/barrel price cap on Russian oil. It will be important to see how global oil producers such as OPEC+ respond in kind and how it impacts energy prices in 2023.

Ukraine and Russia are two of the largest agricultural powerhouses in the world producing 12% of the calories consumed globally. The war has been catastrophic for the Global South that rely on their grain exports and Russia’s fertilizer leading to an additional 47 million people pushed into food insecurity.

Looking ahead: Concerns abound whether the Black Sea-Grain Initiative can last, determining how much agricultural land/equipment is ruined in Ukraine, and how much lower next year’s crop in Ukraine will be.

The combination of consumer habits and government spending during the pandemic (core) and Russia’s war impacting energy and food prices (non-core), led to the highest levels of inflation developed economies experienced in a generation. Central banks around the world responded by raising rates at their fastest pace in living memory. In 2023, the story will slowly change as inflation begins to slow with the IMF predicting that global inflation will decline from 8.8% to 6.5%.

Looking ahead: Central Banks will remain nervous about inflationary pressures including China’s reopening, climate-impacted harvests, and Europe’s energy demand/consumption heading into the winter of 2023-3024.

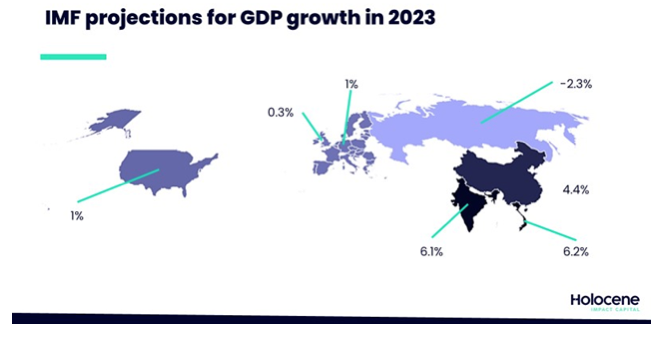

After fast interest rate hikes, much of the rich world is expected to dip into recession in 2023 bringing down global growth from 3.2% in 2022 to 2.7% in 2023.

Europe is expected to fare worst given it its overreliance on previously cheap Russian energy. This tension will be felt for some time yet with concerns flaring up again in the run–up to winter with energy storages needing to hit 95%.

The U.S. will do better than Europe, but concerns will be focused on the labour market which reported a slowdown in December.

India and Vietnam will benefit the most from shifting supply chains by firms looking to distance themselves from China propelling their economies to grow by 6.1% and 6.2% respectively.

Looking ahead: It will be important monitor how different countries manage the differing drags on their economies in 2023.

Since 2011 when the Obama administration announced its ‘Pivot to Asia’, the world has been caught in the grips of a new Cold War.

This new cold war has already led to, and will continue to shape 4 major implications.

For Europe, the war in Ukraine has redoubled the importance of NATO and led the previously neutral countries of Finland and Sweden to request to join the alliance.

In the Middle East, Iran is still looking to gain nuclear proliferation. This has led former adversaries of Israel and the Gulf states to reach not only peace agreements but intelligence sharing cooperation to counter Iran as they feel they can no longer rely on the US to lead in the Middle East.

In Asia, we’ve already seen the Quad grow in importance and the launch of AUKUS – both US-led clubs intended to curb China’s military ambitions in the region.

Looking ahead: Policymakers and business leaders will grow increasingly wary of ‘non-friendly’ jurisdictions and will look to invest heavily in political-risk intelligence and solutions.

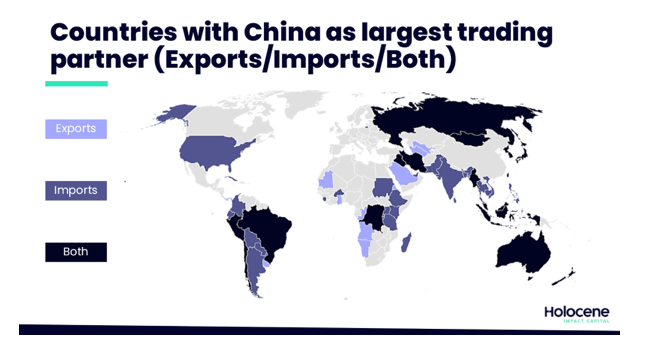

The new cold war along with the shocks of the pandemic already led many to conclude that the end of globalisation is ‘over’. While it may be over for some, that will be tricky to realise overnight.

According to the WTO, China is the largest exporting market for 32 countries, the largest source of imports for 45 countries, and the largest trading partner for both imports and exports for 19 countries. Due to the size and connectedness of the Chinese market to the global economy, it will not be possible to realistically remove it entirely in a new Cold War like previous barriers between the US and former USSR.

Looking ahead: From 2023 on, countries and businesses will begin to consider a sensitive balance between their largest trading partner (China) and the largest guarantor of their security (US). Other countries, such as India and Vietnam will stand to benefit from these awkward conversations.

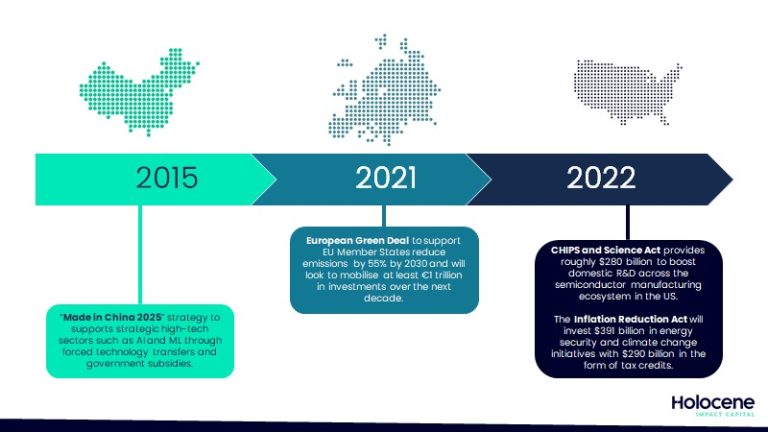

Looking ahead: It will not only be important to see what new legislation is passed, but how it will support specific industries in each country and how allies respond in-kind in a race to bottom to attract private capital.

China has grown to be not only the largest military on earth but also one of the most heavily invested. In recent years it has begun to flaunt this newly gained military heft around from the Himalayas through clashes with India on their contested borders to the Pacific with ever increasing tensions with Taiwan. More worryingly, China has been closely monitoring how the war in Ukraine has impacted Russia’s standing in the world to learn from its mistakes for a potential invasion of Taiwan.

Looking ahead: Some military researchers are predicting 2027 to be the year China decides to take reclaim Taiwan through military force. Should China invade Taiwan, all eyes will be on the U.S. to see if it comes to the defense of Taiwan following President Biden’s comments in 2022.

With every passing year, climate change is shaping both physical landscapes through natural disasters and political landscapes at high-level summits with world leaders. This issue of our time will lead to 2 major implications in 2023.

Until 2022, most discussion surrounding renewable energy was focused on reducing emissions and affordability. With the war in Ukraine, talk of energy ‘independence’ came to the forefront in policy and security circles as a means of protecting their nations from external shocks.

Looking ahead: Countries will begin to view renewables not only as climate-friendly solutions, but also as strategic assets to protect as part of their national interest, potentially gaining more funding for the transition to a cleaner economy because of it.

Concerns surrounding ‘greenwashing’ in the financial sector grew with many investors complaining about a lack of transparency or standardisation on what ‘green is. This will begin to change in 2023.

Looking ahead: It will be important to see what impact these reporting standards have, how prevalent they’re adopted and what pushback it might lead to.

After over 1,000 days of being walled off from the rest of the world, the Middle Kingdom has finally opened itself up to the rest of the world. This will lead to 3 major implications.

With China opening up and its economy set for a rebound, there will be a huge increase in aggregate global demand in commodities. China alone accounts for 1/5 of global oil and 3/5 of iron ore demand.

Looking ahead: Central bankers around the world should brace for an uptick of inflation in the middle-to-end of 2023 even after raising rates so high previously.

The reason behind China’s reopening was its abandonment of its zero-covid policy. From a health perspective, the prospects are grim with The Economist projecting up to 1.5 million people potentially dying from the disease. From a business perspective, the sudden impact on Covid on the economy will disrupt supply chains throughout the country from manufacturing through export distribution.

Looking ahead: Depending on the severity of disruptions to operations, foreign business leaders may speed up their exit plans from China sooner than anticipated and re-shore either elsewhere in the continent or closer to home.

After 3 years of being stuck at home, tourists in China will be keen to go on holidays abroad. This opening of the borders will help increase international arrival numbers rise by 30% and tourism spending numbers will reach near 2019 heights of $1.4 trillion.

Looking ahead: While tourist hotspots already fared well in recent years, expect a further bump in economic growth in those regions. One underlying risk is if there will be enough staff and hospitality facilities to support this return to pre-pandemic tourism levels.

If you would to learn more about the work we do at HIC or how we can help your sustainable project get off the ground, get in touch by emailing info@holoceneic.com.