Three reasons to be bullish about Polish real estate market in 2024

Tomasz Wozniak

Tomasz Wozniak  January 10, 2024

January 10, 2024  Tomasz Wozniak

Tomasz Wozniak  January 10, 2024

January 10, 2024 On October 15 2023, Poland went to the polls. The result: the incumbent Law and Justice (PIS) party would be ousted by a new coalition headed by Donald Tusk, a former President of the European Council.

This electoral victory, despite a rocky handover, has led to renewed excitement about Poland and its economic prospects. With the new Prime Minister looking to re-engage with the rest of the European Union (EU), there has been a growing sense of optimism that Poland could return to working with the block as opposed to working against it from within. Following a series of expected reforms, such as restoring the independence of the courts, the EU would then look to unlock €60 billion of previously frozen funds for the country.

However, even without this recent electoral win, there are many reasons to be bullish about the Polish economy.

Poland has a strong track record for growth. Its economy is expected to continue to grow. Its population is younger than the EU average. And now there is a government in place waiting to take advantage of these factors.

In the rest of this briefing, we explore exactly why we are excited about three developments in the real estate market in Poland.

The first market we are excited about in Poland is that of student accommodation. Across the EU, JLL estimates that there is a shortage of nearly 5 million student beds. In Poland, this need is especially acute, at around 400,000 beds because of 2 reasons.

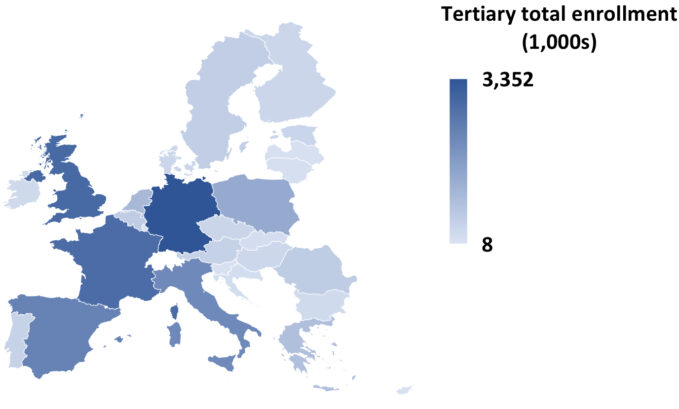

The first reason is the low quality of the existing stock of student accommodation across the country. According to estimates, around only 1% of students in the country can expect to stay in modern accommodation. The second reason is the size of the market. At 1.2 million, Poland ranks 6th in the EU for the number of students studying in university.

The second market we are excited about is the potential rollout of a formal Real Estate Investment Trust (REIT) ecosystem in Poland. At a high-level, REITs are companies (public or private) that own, operate, or finance income generating real estate. Similar to mutual funds, they allow numerous investors to pool their capital together to invest in the real estate market without having to finance entire properties themselves and have the added benefit of it being a much more liquid form of investment.

In Poland, the real estate market is especially ripe for disruption, considering that 70% of all apartments bought in the country in 2023 were for investment purposes. For comparison, in the neighbouring Czech Republic, also in the EU and the CEE region (Central Eastern Europe), 60% of all capital invested in commercial real estate was through REITs. Now with the new government coming in, and coalition partners are already asking for REITs to be revisited in the coming year, expect significant progress to evolve in this policy space in the coming year.

The final market we are excited about in Poland is the hotel and tourism sector. Poland ranks a whopping 2nd in the world for the number of overnight arrivals, positioned just behind France. This is measured on the number of arrivals, not the number of people, meaning that if a person makes several trips to a country, each one is counted as an arrival. In 2022, the number of nights stayed rose by 23% year over year. As for the revenue per available room, Poland’s hotels saw a bump of 19% in 2023.

However, despite these positive developments, there is a continued lack of developments in the pipeline. Between 2015-2023, the number of hotel rooms only grew at an annual rate of 3%. While there are a number of projects currently in the works, one of the main concerns holding developers back is the high barriers to securing debt and development financing.

For these reasons and more, at Holocene we have gone all in on Poland. From 2024 onward, we have secured financing solutions for real estate (and infrastructure) projects in Poland – including both traditional and non-banking lending solutions.

If you would like to learn more about the financing solutions available in Poland, write to us as at info@holoceneic.com.